5 Year Term Deposit Rates

| Provider | Rate | |||

|---|---|---|---|---|

|

State Bank of India Australia 60 Month Term Deposit Minimum deposit of $250,000 required for residents. Minimum $20,000 for non-residents. |

2.15% 5 Year | Aug 2019 | |

|

Bendigo Bank 5 Year Term Deposit The interest rate for this one year product is at maturity and deposit balances ranges requires a minimum of $5,000 up to amounts over $5,000,000. |

1.45% 5 year | Jan 2020 | |

|

Citibank Australia 5 Year Term Deposit Rates applicable with minimum opening balance of $10,000 and interest paid monthly, quarterly, annually or at maturity. |

1.29% 5 year | Jun 2019 |

In Australia, 5 Year term deposit rates are longest maturity deposit option provided by banks for retail customers. These rates also are typically provide the highest interest rate offerings due to the longer time frame that the funds are not added to as well not able to be used.

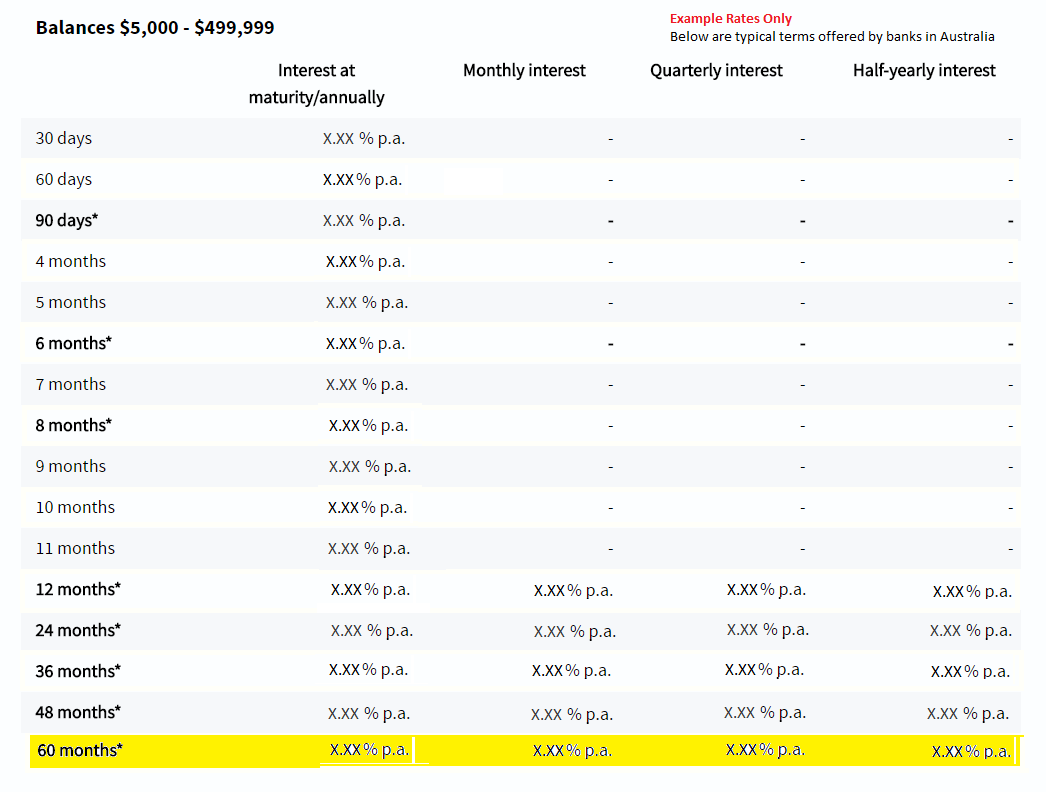

The below picture is an example (rates not current) from a large bank in Australia and shows the typical term offerings available. As you can see 5 year rates are paid monthly, quarterly, half year and at maturity or annually.