1 Month Term Deposit Rates

| Provider | Rate | |||

|---|---|---|---|---|

|

Bank of Sydney 1 Month Term Deposit Rate shown is applicable to deposits ranging from $250,000-$1,000,000 with interest calculated daily and paid at maturity. |

1.55% 1 month | Aug 2019 | |

|

Citibank Australia 1 Month Term Deposit Rates applicable with minimum opening balance of $10,000 and interest paid monthly, quarterly, annually or at maturity. |

1.40% 1 month | Jun 2019 | |

|

Suncorp Bank 1 Month Term Deposit Rate indicated is for the range between $100,000 to $499,999. |

1.25% 1 Month | Aug 2019 | |

|

Credit Union Australia 1 Month Term Deposit Rate quoted is has minimum investment of $5,000. |

1.00% 1 Month | Sep 2019 | |

|

Bendigo Bank 1 Month Term Deposit The interest rate for this one year product is at maturity and deposit balances ranges requires a minimum of $5,000 up to amounts over $5,000,000. |

0.50% 1 month | Jan 2020 | |

|

0.05% 1 MONTH | Jul 2024 |

In Australia, 30 day also known as 1 month term deposits (TD) are one of the shortest maturities products available from banks and credit union for interest bearing deposits. In contrast to savings accounts, 30 days like other TD products cannot be added to but are much closer to the savings rate than longer maturities like 5 year TDs.

Interest from 1 Month deposits are paid monthly as per the following example from a large bank.

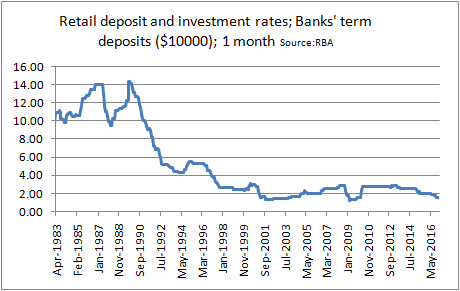

Data aggregated from the RBA indicates that 1 month rates have also fallen over time especially compared to the 1980s.