6 Month Term Deposit Rates

| Provider | Rate | |||

|---|---|---|---|---|

|

4.70% 6 MONTH | Apr 2024 | ||

|

3.70% 6 MONTH | Apr 2024 | ||

|

Suncorp Bank 6 Month Term Deposit Rate indicated is for the range between $100,000 to $499,999. |

2.05% 6 Month | Aug 2019 | |

|

State Bank of India Australia 6 Month Term Deposit Minimum deposit of $250,000 required for residents to open the account. Minimum deposit of $20,000 for non-residents. |

2.00% 6 Month | Aug 2019 | |

|

AustralianSuper 6 Month Term Deposit You can invest in this option if you are an AustralianSuper member and have more than $10,000 in the account. |

1.82% to 2.20% 6 month | Aug 2019 | |

|

Bank of Sydney 6 Month Term Deposit Rate shown is applicable to deposits ranging from $250,000-$1,000,000 with interest calculated daily and paid at maturity. |

1.80% 6 month | Aug 2019 | |

|

Credit Union Australia 6 Month Term Deposit Rate quoted is has minimum investment of $5,000. |

1.75% 6 Month | Sep 2019 | |

|

Rural Bank 6 Month Term Deposit Rate indicated is for Online Term deposits between $5000 to $1 million. |

1.60% 6 Month | Sep 2019 | |

|

Citibank Australia 6 Month Term Deposit Rates applicable with minimum opening balance of $10,000 and interest paid monthly, quarterly, annually or at maturity. |

1.31% 6 month | Jun 2019 | |

|

Bendigo Bank 6 Month Term Deposit The interest rate for this one year product is at maturity and deposit balances ranges requires a minimum of $5,000 up to amounts over $5,000,000. |

0.50% 6 month | Jan 2020 |

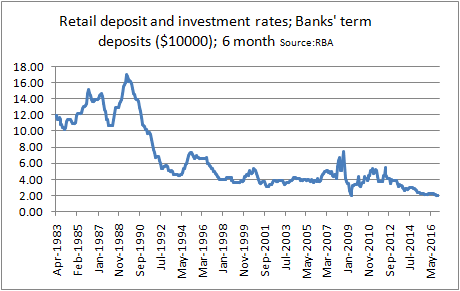

The 6 month TD product is a popular offering provided for retail customers from banks. Considered a short term product, it is heavily influenced by RBA decision directions.

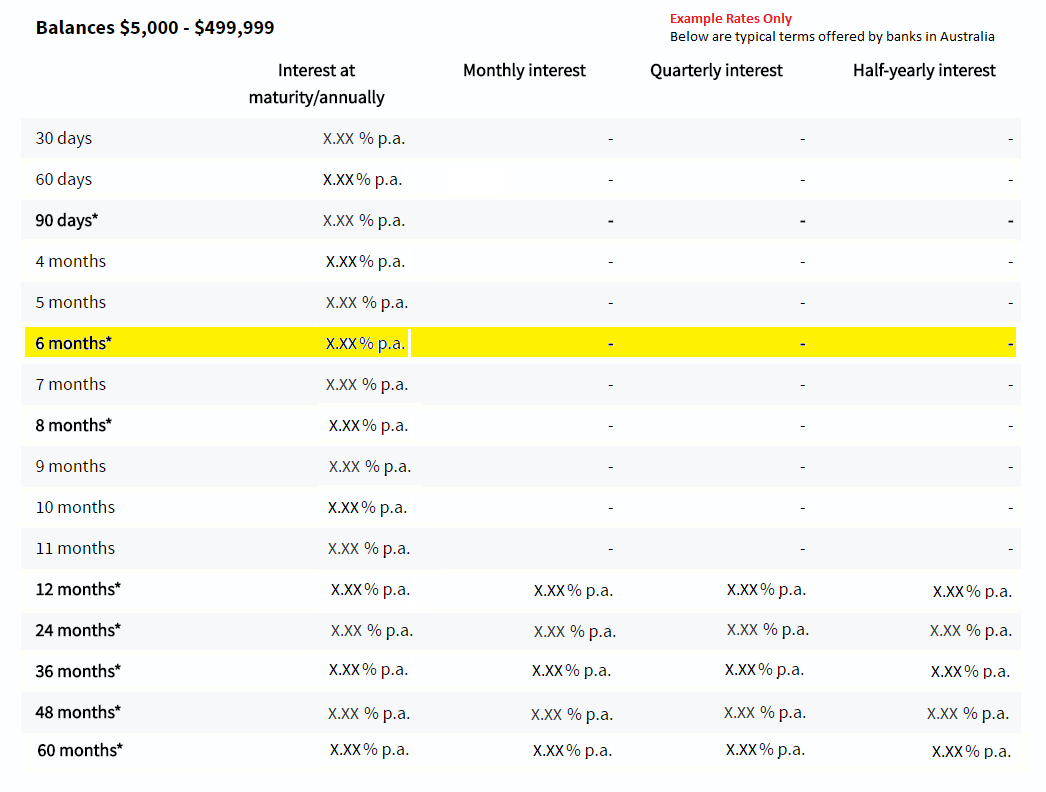

Below shows the interest payment options from a large national bank in Australia.

For such a short term rate it peaked at over 16% in 1988/1989 falling to about 2% in 2016.