Home Loan requirements from providers

In Australia, since 1 January 2012, all lenders who would offer standard home loans will need to provide a key facts sheet when a borrower asks them. These fact sheets will be in a standard format so you can compare against other home loans from other providers. Facts will include loan amounts and terms, interest rates, comparison rate(also known as APR internationally), the amount to be paid back including fees and any establishment fees.

Home Loan Deposit and Mortgage Insurance

When obtaining a mortgage loan in Australia, it is recommended that the borrower has at least a 20% deposit. If the borrower was to borrow more than 80% of the purchase price of a property they may be subject to lenders mortgage insurance (LMI) which insures the lender against default from the borrower. The added LMI fee from a lender could be many thousands of dollars that could be added to the home loan.

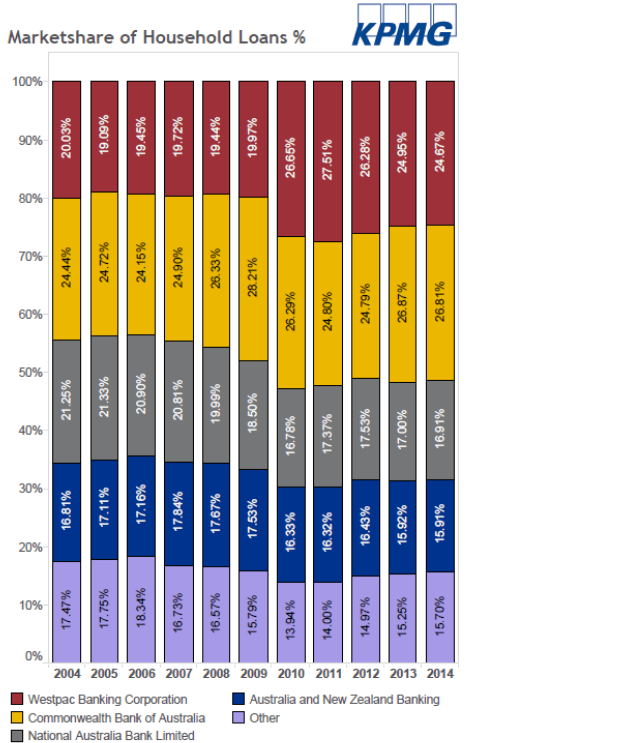

Domination of mortgage market share by big banks

The Australian big banks had the largest market share for mortgages in Australia with the largest 4, Commonwealth Bank,Westpac, National Bank of Australia and ANZ having share combined over 80% according to KPMG (kpmg.com.au)